[exchanges-list]

Finding the best cryptocurrency exchanges and trading platforms is no small feat. You may not have the time, capital, or expertise to go through every single exchange with a fine-tooth comb. Lucky for you, we have done all the heavy lifting. BeInCrypto has ranked the top exchanges based on 24-hour trading volume, market spread, and coins. We also discuss fees, deposit limits, withdrawal limits, ease of use, and security.

- What is a crypto exchange?

- Best cryptocurrency exchanges in 2024

- Comparison: best cryptocurrency exchanges

- Crypto exchange comparison methodology

- What type of cryptocurrency exchanges are there?

- Which bitcoin exchange is safest?

- Is bitcoin a good investment for 2024?

- Which bitcoin exchange has the lowest fees?

- No solutions, only tradeoffs

- Frequently asked questions

What is a crypto exchange?

A crypto exchange is a place where traders and investors go to buy cryptocurrency. An exchange primarily makes crypto purchases available. However, many also provide services, including derivatives trading, margin trading, staking, yield farming, and liquidity mining.

Cryptocurrency exchanges are the gateway to the world of cryptocurrency for most people. They provide an easy way to on-ramp users into the world of crypto.

Best cryptocurrency exchanges in 2024

1) StormGain

Getting started with Stormgain only takes a few minutes. All you need to do is register an e-mail. Stormgain provides an attractive 500x leverage for those experienced enough to take advantage. There is also a mobile app for Android and iOS.

Supported coins

Stormgain offers cryptocurrency trading for more than 50 cryptocurrencies, including BTC, DOGE, SOL, AVAX, and ETH.

Fees

- There are zero deposit fees for those who deposit with cryptocurrency or via SEPA transfer incurs no fees.

- There are no fees for using a Mastercard credit or debit card to deposit (only for E.U. countries).

- Simplex charges 3.5% (or $10 USD, whichever is greater) for credit card deposits, while Koinal charges 4% (the conversion on the Koinal side of the transaction should also be taken into account).

- Fees for trading are 0 for non-profitable trades and 10% for profitable.

- The fees for leveraged trading depend on the cryptocurrency pair. For example, if you create an order with a leverage of 300, your fees will be multiplied by 300.

- Moreover, Stormgain has fixed and additional withdrawal fees.

Minimum deposit

Stormgain’s minimum deposit varies by cryptocurrency. The minimum deposit for each currency is as follows: 0.00003 BTC, 0.003 BCH, 0.001 ETH, 0.0072 LTC, and 4 XRP. Each cryptocurrency minimum deposit should be approximately equivalent to 10 USDT. For deposits in fiat, the sum depends on the deposit method.

Cloud mining

Get access to powerful BTC cloud-mining software; earn free Bitcoin in USDT. You can trade with it and withdraw your profit whenever you want. All mining is done on StormGain’s cloud mining equipment, not your local device.

Is Stormgain safe?

The phone application has a built-in wallet, and the exchange has two-factor authentication for individual users. Furthermore, Stormgain has never been hacked.

Pros and cons

| Pros of Stormgain | Cons of Stormgain |

| ⊕ Easy-to-use interface | ⊗ Does not allow fiat deposits |

| ⊕ Offers leverage rates from 5x-500x | ⊗ More than 50 cryptocurrencies |

| ⊕ Built-in wallet | |

| ⊕ BTC Cloud Mining |

Click here to sign up for StormGain with only an email address now!

2) Binance

Binance is a global cryptocurrency exchange. The platform launched in 2017 and has become an industry giant. The exchange is advanced and has several interesting tools for more experienced users. The Binance exchange offers basic conditional orders, such as stop-limit orders, but does not have trailing stops.

Fees

- Fees are generally 0.1%. If a user uses BNB for trading, they receive a reduced fee. The reduction depends on the time you have been trading and the total amount of BNB you hold.

- The exact fees are based on the past 30-day trading volume, whether the order is a market maker or a taker, and BNB holdings. They range from 0.02% to 0.1% for the maker and 0.04% to 0.1% for the taker.

- There are no deposit fees.

- The withdrawal fees are quite small. However, the fees differ based upon the asset and chain you are withdrawing to (e.g., BTC: BEP20, ERC20, SegWit, etc.)

Withdrawal limits

The withdrawal limit depends on the level of verification. It is 8 million USD for regular accounts and increases to 96 million USD for VIP users.

Margin trading

Finally, the exchange offers margin trading up to 125x. It has a very helpful “margin meter,” which shows how close you are to having your funds forcibly liquidated.

Is Binance safe?

Binance employs two-factor authentication for individual users. The exchange was hacked in May 2019 and lost $40 million, but it repaid its users.

Pros and cons

| Pros of Binance | Cons of Binance |

| ⊕ Low trading fees | ⊗ Not suitable for beginners |

| ⊕ Multiple trading pairs | ⊗ High withdrawal fees |

| ⊕ Offers margin trading |

Click here to get started trading on Binance now!

3) Bybit

Bybit is a Singapore based cryptocurrency exchange headquartered , founded in 2018. Ben Zhou founded Bybit after a transition from a lengthy career in traditional finance at XM.

One of the best features of the exchange the ‘Top gainers,’ ‘Newly listed,’ and ‘Trending’ lists, which allows for identifying lesser-known coins that have been increasing at a high rate. Bybit is also a good place to trade derivatives, such as options and perpetuals.

If you are not an experienced trader you can also utilize the demo trading feature. Moreover, this exchange allows copy trading, trading bots, and utilizes a Metatrader 4 platform.

Bybit supported coins

Bybit supports about 480 coins and tokens and is available in many countries.

Fees

- Bybit does not charge any extra fees for deposits of cryptocurrencies or internal transfers.

- Options trading fees are 0.2%

- Perpetual and futurs taker fee is 0.055% and the maker fee rate 0.02%

- Their spot trading fees are 0.1%

Is Bybit safe?

Bybit stores its users’ funds in secure, offline cold wallets to protect against unauthorized online access. They employ advanced security measures, including multi-signature technology,

Trusted Execution Environment (TEE), and Threshold Signature Schemes (TSS), to further safeguard these assets. Additionally, Bybit is committed to transparency and regularly conducts Proof of Reserves audits, the results of which are made public.

Pros and cons

| Pros of Bittrex | Cons of Bittrex |

| ⊕ Zero fees on crypto deposits | ⊗ The interface is not user friendly |

| ⊕ Diverse set of products and features |

4) Kraken

Kraken is a U.S.-based cryptocurrency exchange that was founded in 2011. Kraken’s trading chart is quite advanced, offering many technical indicators and different time frames. It also offers conditional trading, including stop/limit orders. Finally, Kraken offers futures trading, a way to amplify profits with 50x leverage, over-the-counter desk, and cryptocurrency indices.

Supported coins

Kraken supports more than 200 cryptocurrencies. However, some are not available in certain countries and jurisdictions.

Fees

- Fees are not fixed but rather depend on the previous 30-day volume, payment method, and whether the order is a market maker or taker.

- For cryptocurrencies, the fees range from 0%-0.16% (maker) and 0.1%-0.26% (taker).

- For stablecoins like Tether (USDT), the fees range from 0-0.2%, without regard to whether you are a maker or taker.

- The margin fees are a fixed rate of 0.02% + 0.02% every four hours on trading pairs.

Deposit limits

- Additionally, Kraken allows depositing fiat currencies into the exchange. The deposit limits are $100,000 daily for the Intermediate account and $10,000,000 for the Pro account. If you only have a starter account, you are not allowed to deposit any fiat currencies.

- A bank/wire transfer is necessary in order to make a deposit since Kraken does not support credit cards.

- For U.S. residents, the Fedwire method allows better conditions, with a minimum deposit of only $100 and a fixed fee of $4. The deposit takes only 1-3 business days to be completed.

Withdrawal limits

- While the daily deposit allowance for cryptocurrencies is the same, the withdrawal allowance changes based on the verification level. There are three verification levels — Starter, Intermediate, and Pro.

- In a period of 24 hours, there is a $5,000 withdrawal limit (worth in cryptocurrency) for the starter account, $500,000 for intermediate, and $10,000,000 for Pro accounts.

Borrowing limits

The borrowing limits differ by currency (USD, EUR, BTC, ETH) for the starter, intermediate, and pro accounts respectively. The maximum amount that you can borrow is $15 million (USD).

Is Kraken safe?

Kraken is registered with FinCEN in the U.S. as a Money Services Business (MSB). Kraken Futures (CryptoFacilities) is regulated by the Financial Conduct Authority (FCA), the UK’s primary financial regulatory body.

The process of opening an account is straightforward. You only need an e-mail address in order to receive the activation mail. Note that the platform does not serve the following countries: Afghanistan, Cuba, Iran, Iraq, Japan, North Korea, and Tajikistan.

| Pros of Kraken | Cons of Kraken |

| ⊕ Margin trading | ⊗ Fees change often |

| ⊕ Low trading fees | ⊗ Does not support credit cards |

| ⊕ Advanced trading charts | ⊗ Slow customer service response |

5) Coinbase

Coinbase is one of the most well-known and best-trusted cryptocurrency exchanges. It is based in the U.S. and is a publicly traded company. Coinbase is a distributed company, so it does not have a headquarters.

Supported coins

Coinbase offers hundreds of cryptocurrency trading pairs.

Fees

- For depositing, Coinbase charges $10 for Wire (USD) and €0.15 EUR for SEPA (EUR). Deposit is free for ACH and SWIFT (GBP).

- Withdrawal fees are fee for ACH, $25 for Wire, €0.15 EUR for SEPA, and £1 GBP for SWIFT.

- Coinbase charges a flat 1% transaction fee on all cryptocurrency transactions.

- In addition, it charges a variable fee depending on the transaction type, amount, and region.

Deposit limits

Deposit and withdrawal limits are up to $25,000 with a verified account.

Is Coinbase safe?

Coinbase prioritizes the security of its customer’s funds. All digital currency held by Coinbase is insured. If Coinbase were to suffer a breach of its online storage, the insurance policy would cover any funds lost as a result. Coinbase holds less than 2% of its customers’ funds online. The rest is held in offline storage.

Pros and cons

| Pros of Coinbase | Cons of Coinbase |

| ⊕ Responsive customer support | ⊗ Complex pricing structure |

| ⊕ Wide range of products | |

| ⊕ Fiat deposits |

Click here to get started on Coinbase now!

6) KuCoin

Kucoin is a relatively new exchange. It opened in 2017 and offers its own coin, Kucoin Shares (KCS). Holding KCS offers several benefits to users. The interface is quite advanced. It offers various indicators and several time-frames that are not present in other exchanges.

The exchange offers conditional orders, such as stop limits, but not margin trading. Finally, Kucoin allows listing tokens. It reserves the right to de-list any token if it meets certain criteria with 30 days prior notice.

Supported coins

Kucoin offers hundreds of cryptocurrencies.

Fees

- Fees are based on the prior 30-day trading volume, the amount of KCS held, and whether the order is a maker or taker.

- The maker fees range from 0.1%- (-)0.005%, and the taker fee ranges from 0.1%-0.025%.

Deposits

- Kucoin allows depositing cryptocurrencies but not fiat currencies. There are no fees for depositing cryptocurrencies.

Withdrawal limits

- For withdrawing, the fee is 0.0005 for BTC and 0.01 for ETH. As for the withdrawal limits, they depend on the verification of the account.

- A non-verified account has a withdrawal limit of 1 BTC in a span of 24 hours. The limit increases to 200 BTC for a verified account, while an institutional account is allowed to withdraw 3,000 BTC.

Is Kucoin safe?

- Kucoin offers two-factor authentication. Even though it is still new, it has not had any security issues.

Pros and cons

| Pros of Kucoin | Cons of Kucoin |

| ⊕ 200+ trading pairs | ⊗ Withdrawal limits |

| ⊕ Advanced trading interface | ⊗ Trading fees are not fixed |

| ⊕ Token listings |

Click here to get started trading on KuCoin now!

7) CEX.io

CEX.io was established in the UK in 2013. Users can use ACH payment without any commission only if they are a resident of the U.S. The trading interface is extremely simple but lacks several key indicators. CEX also allows listing coins and reserves the right to delist any coin with prior notice of 30 days.

Fees

- Fees for trading depend on volume 30 days prior and whether the order is a maker or taker.

- For a market maker, fees range from 0%-0.15%, while for takers, they range from 0.1%-0.25%.

- The exchange allows depositing fiat funds in order to buy cryptocurrency. It has a fixed commission of 2.99% for credit card payments.

CEX deposit limits

Deposit limits range from unlimited to $1000-$10,000 on a daily basis. Additionally, Cex.io is available in every country except for Iceland, Vietnam, Afghanistan, Algeria, Bahrain, Iraq, Kuwait, Lebanon, Libya, Nigeria, Oman, Pakistan, Palestine, Qatar, Saudi Arabia, and Yemen.

If you want to buy cryptocurrency with fiat, it is recommended to do so on the ‘Trade’ page instead of the homepage. Doing so on the homepage will take a fee of seven percent, even though it only places the order for you, as opposed to you doing it manually.

Is CEX safe?

Opening an account is straightforward. In order to verify the account, which greatly enhances your depositing/withdrawal capabilities, you need to send a picture with a government-backed ID and a scanned picture of said ID. CEX states that user IDs and credit card details are stored for at least five years after accounts are deleted.

CEX claims to use offline cold storage to store users’ funds, although it does not provide additional detail on where or how it undergoes this process. The platform offers two-factor authentication. The exchange suffered a hacking incident in 2013 when it was in its infancy. The vulnerability was solved at that time, and there have been no reported security incidents since.

Pros and cons

| Pros of CEX | Cons of CEX |

| ⊕ Simple trading interface | ⊗ Limited range of crypto |

| ⊕ Fast account opening process | ⊗ Deposit limits |

| ⊕ Fiat deposits | ⊗ High card fees |

8) Huobi

Huobi is a Hong Kong-based exchange that opened in 2013. It possesses a strong community, diversified across a Telegram channel, Subreddits, and Instagram. Huobi offers margin trading with leverage up to 200x.

The interface offers different time frames and several trading indicators. It is both user-friendly for novices and offers more advanced tools for seasoned traders. An interesting feature is that it shows statistics for coins, such as whitepapers and circulating supplies.

Supported coins

Huobi provides hundreds of cryptocurrencies for trading.

Fees

- For normal users, the fees range from 0.07%-0.18%, depending on how many Huobi Coins you have and the previous 30-day volume. Otherwise, the fee is 0.2%.

- For professional users, the fees range from 0.0097%-0.0362% for market makers and 0.0193%-0.0462% for market takers.

- For crypto-fiat trading, the fees are 0% for market makers.

- For withdrawals, the fees are quite small. For example, withdrawing BTC has a fee of 0.0004 BTC.

Withdrawal limits

The withdrawal limits are 0.06 BTC for unverified users.

Deposits

Huobi allows for the deposit of fiat currency through the Huobi OTC. There are no fees for depositing crypto into your Huobi account.

Is Huobi safe?

Huobi Wallet is a cold storage professional multi-chain wallet. Its users have full control over their assets. There are no third parties involved in managing the private keys. ID verification is available, as is two-factor authorization for trades and withdrawals. In case of a hack, Huobi keeps reserves in order to repay users.

Pros and cons

| Pros of Huobi | Cons of Huobi |

| ⊕ Wide range of cryptos for trading | ⊗ No fiat withdrawals or deposits |

| ⊕ Responsive customer support | ⊗ Complicated registration |

| ⊕ Offers margin trading up to 5x |

9) BitMEX

BitMEX is a cryptocurrency exchange that opened in 2014 and is primarily known for leverage trading. The platform offers stop limits, trailing stops, and different types of orders. It also offers margin trading with leverage up to 100x.

Fees

- Currently, spot trading on BitMEX differed between market makers or takers for spot trading. The market maker fee is -0.025%, while the taker fee is 0.075%.

- Derivatives fees differ by account level. Generally, maker fees range between (-)0.01%-0.02%, and taker fees range between 0.0175%-0.075%.

Perpetuals leverage rates

BitMEX offers different leverage rates for different cryptocurrencies:

- 20x: MATIC, Avalanche (AVAX),

- 33x: Litecoin (LTC), Cardano (ADA), EOS (EOS)

- 50x: Chainlink (LINK)

- 100x: Ethereum (ETH)

Is BitMEX safe?

All of the funds are kept in cold storage. In addition, all of the BitMEX addresses are multi-signature. No private keys are kept in cloud storage. Finally, every single withdrawal request on BitMEX is audited by at least two BitMEX employees before being sent.

Pros and cons

| Pros of BitMEX | Cons of BitMEX |

| ⊕ Margin trading up to 100x leverage | ⊗ It doesn’t support fiat deposits |

| ⊕ Suitable for advanced traders | |

| ⊕ Futures and perpetual contracts |

Click here to get started on BitMEX now!

10) Bitstamp

Bitstamp is an exchange that debuted in 2011, based in Luxembourg. Opening an account is straightforward; however, you need to verify the account in order to make simple trades. This contrasts with other exchanges that limit deposits and withdrawals but allow you to use your account pre-verification. In addition to the ID verification, Bitstamp requires proof of residence in one of the countries that are supported.

The exchange does not offer margin trading. The trading interface offers basic conditional orders but no trailing stops or other advanced conditional orders. The basic chart offers key indicators. Using a ‘Pro’ account for institutional traders offers an advanced interface, more aggregators, and more indicators.

Deposit & withdrawal limits

ACH withdrawals have a limit of $50,000 per transaction, while FPS payments have a limit of 250,000 GBP. There is no maximum deposit on BitMEX.

Supported coins

Bitstamp offers very few coins and tokens, less than 20.

Fees

- The trading fees depend on the previous 30-day volume.

- The taker fees range from 0%-0.4%. Maker fees range from 0%-0.3%.

- Bitstamp allows fiat depositing via three methods: Credit card, SEPA, and international wire transfer.

- Cryptocurrency deposits are free, while withdrawal fees vary on cryptocurrency.

Is Bitstamp safe?

Bitstamp offers a secure mobile wallet in app form. All digital funds are placed in cold storage. Bitstamp has been the victim of hacks in the past, most notably in 2014 and 2015. In the latter instance, 19,000 BTC were stolen.

Pros and cons

| Pros of Bitstamp | Cons of Bitstamp |

| ⊕ Quick account opening | ⊗ KYC required for all trades |

| ⊕ No deposit/withdrawal limits for verified users | ⊗ Trading fees are not fixed |

| ⊕ Fiat deposits | ⊗ High credit card fees |

Comparison: best cryptocurrency exchanges

| Platform | 24-Hour Vol (Spot) | Proof of Reserves/Attestations | Coin/Tokens | Fiat | Best Feature |

|---|---|---|---|---|---|

| Stormgain | ~$3 million | No | 31 | No | Margin trading |

| Binance | ~$27 billion | Yes | 387 | Yes | Advanced trading features |

| Bybit | ~$2 billion | Yes | 486 | Yes | Deposit & withdrawal fees |

| Kraken | ~$1 billion | Yes | 222 | Yes | User interface |

| Coinbase | ~$2 billion | No | 245 | Yes | Learn |

| Kucoin | ~$1 billion | Yes | 812 | Limited | Altcoins |

| CEX.io | ~$5 million | No | 127 | Yes | Loans |

| Huobi | ~$800 million | Yes | 593 | Yes | Liquidity |

| BitMEX | <$1 million | Yes | 10 | No | Perpetuals liquidity |

| Bitstamp | ~$289 million | Published in 2014 | 74 | Yes | Security |

Crypto exchange comparison methodology

As many factors go into creating a cryptocurrency exchange, BeInCrypto evaluated ten exchanges using an assortment of factors. Fees are evaluated compared to industry competitors and categorized by fee structure (e.g., spot trading, options trading, withdrawal, deposit fees, etc.).

Security evaluations are based on multiple scenarios, such as a history of hacks, the percentage of assets in cold storage, or regulation. It should be noted that if an exchange has not been hacked or uses cold storage, it does not guarantee that it will never be hacked.

Furthermore, exchanges offering more features and financial products are weighted more than those offering spot trading. For instance, an exchange that has staking, margin trading, derivatives, or cloud mining will weigh more than a trading platform that only allows you to buy and sell.

Finally, crypto exchanges are also evaluated on other factors, such as 24-hour trading volume, total assets, spread, registration, 24-hour support, or supported coins.

What type of cryptocurrency exchanges are there?

You can break down cryptocurrency exchanges into two broad categories: centralized (CEX) and decentralized (DEX). Companies run CEXs. Centralized exchanges typically facilitate payments between cryptocurrencies and fiat currencies through relationships with banks and payment providers.

DEXs are programs running autonomously on the blockchain through smart contracts. Though they can run autonomously, they are typically guided and upgraded by a decentralized global community of anonymous users. These exchanges can be thought of as peer-to-peer (p2p) platforms, as users provide liquidity for trades instead of a central company.

Which bitcoin exchange is safest?

All crypto exchanges are not created equal. You must consider the many elements that go into an exchange to choose the best one. What percentage of the exchange’s assets are placed in cold storage? Does the platform have adequate reserves, even when compared to liabilities? Are the customers’ funds insured, and who gets paid first during a bankruptcy filing?

These are the questions you must ask yourself when choosing an exchange based on safety. Some exchanges are technologically safe but fiscally unsafe. The safest exchanges are transparent in their business practices and undergo rigorous financial regulation.

Is bitcoin a good investment for 2024?

Personal finance is, as the name implies — personal. Whether or not bitcoin is a good investment in 2024 is entirely up to you. The good news is that there are ways to make money, whether the market goes up or down. If you want to play the long game — as in waiting for a bull market — then bitcoin is at a discount in a bear market. If you want to play the short game, a bear market may be your ideal playing field.

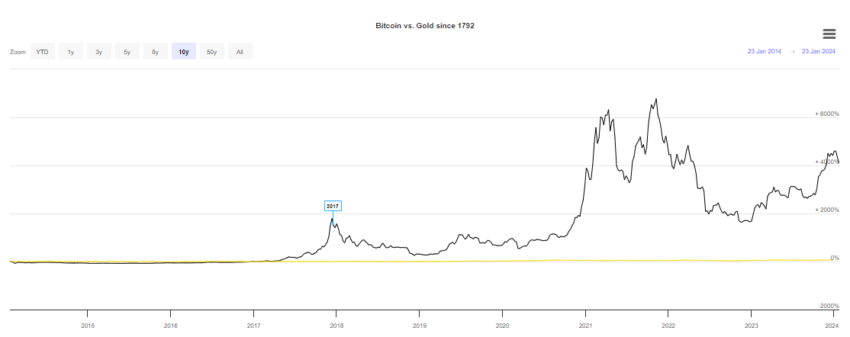

Bitcoin has outperformed gold since its inception. This contributes to the perception that bitcoin is a good store of value and thus makes a good long-term investment.

Which bitcoin exchange has the lowest fees?

If you want to know which exchange has the lowest fees, you will have to break it down by fee structure. Generally, exchanges have spot trading fees, derivatives fees, margin fees, deposit and withdrawal fees, and hidden or extra fees. Currently, BitMex has the lowest fees at 0%.

The exchange with the best futures trading fee is Binance. Many exchanges do not charge deposit fees, and some exchanges only charge a network fee for withdrawals (not “cashing out”). Because of some platforms complicated fee structure, it is difficult to calculate hidden costs and extra fees.

No solutions, only tradeoffs

In the same sense that different tools work for different tasks, certain exchanges work best for certain activities. If the majority of your exposure to crypto is spot trading, then most exchanges will work for you. If you like to trade, you will likely want an exchange with deep liquidity.

Some users may be new to cryptocurrency and just want to trade NFTs. In this respect, they are more than likely looking to avoid the network fees of blockchains. On the other hand, some users want to speculate on the next hot token and will want a market maker with a variety of coins and tokens.

You know what you need and don’t need. Therefore, the best exchange is not a panacea; it is the best exchange for you.